Financial institutions, such as banks, NBFCs and investment firms, play a pivotal role in the global economy and will explore which uncommon features distinguish them . They facilitate diverse activities—banking, lending, and wealth management. Moreover, they influence economic trends. While many share common features, certain aspects set some apart. These unique traits, which we’ll explore in this article, differentiate institutions. Notably, these distinctions impact markets and investments, and thus, understanding them is crucial.

Uncommon Features that Stand Out

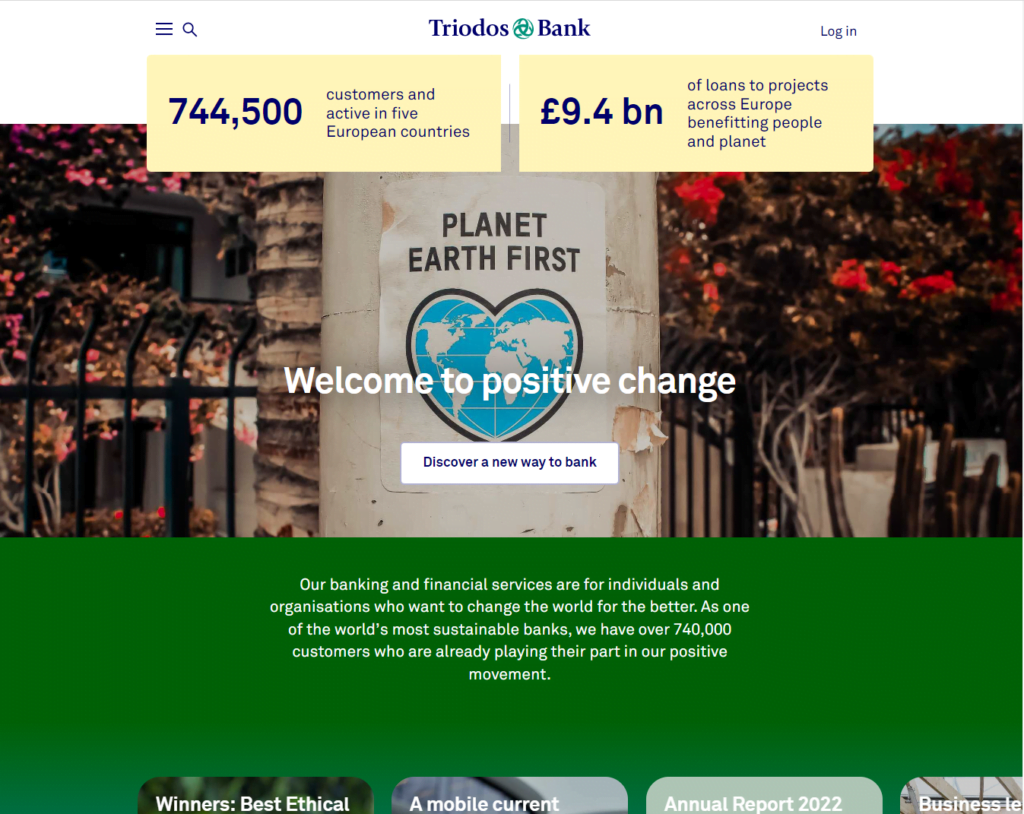

1. Ethical Investment Strategies

While most financial institutions focus on maximizing returns, some prioritize ethical considerations. Uncommon features such as offering socially responsible investment options or sustainable finance solutions showcase a commitment to environmental and social well-being. For example, Triodos Bank emphasizes financing projects that align with their ethical values, such as renewable energy initiatives and community development projects.

2. Microfinance Initiatives

Not all financial institutions cater solely to traditional banking needs. Microfinance institutions, for instance, provide financial services to underserved populations, especially in developing countries. These institutions offer small loans, savings accounts, and insurance to empower individuals who lack access to mainstream financial services. Grameen Bank, founded by Muhammad Yunus , is a prime example of a microfinance institution that has transformed lives through microcredit.

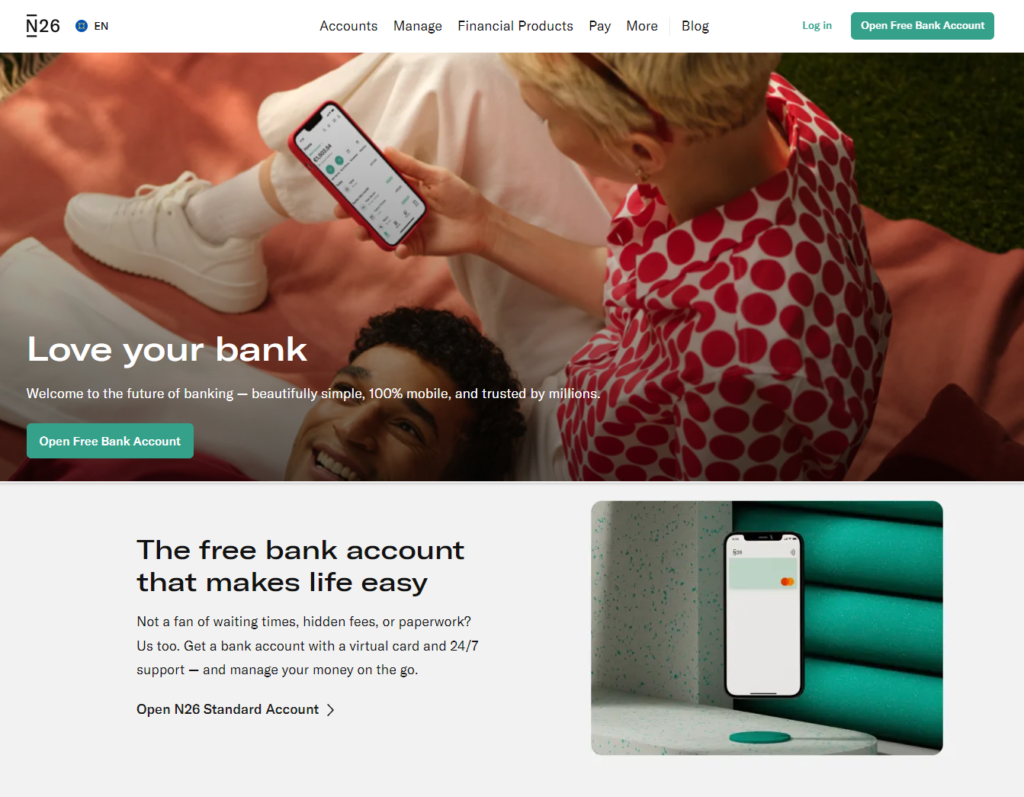

3. Digital-Only Models

In an era of technological advancements, some financial institutions operate solely in the digital realm. These digital-only banks offer a range of services without physical branches. N26 and Revolut are prime examples, providing customers with seamless mobile banking experiences, quick transactions, and personalized financial insights.

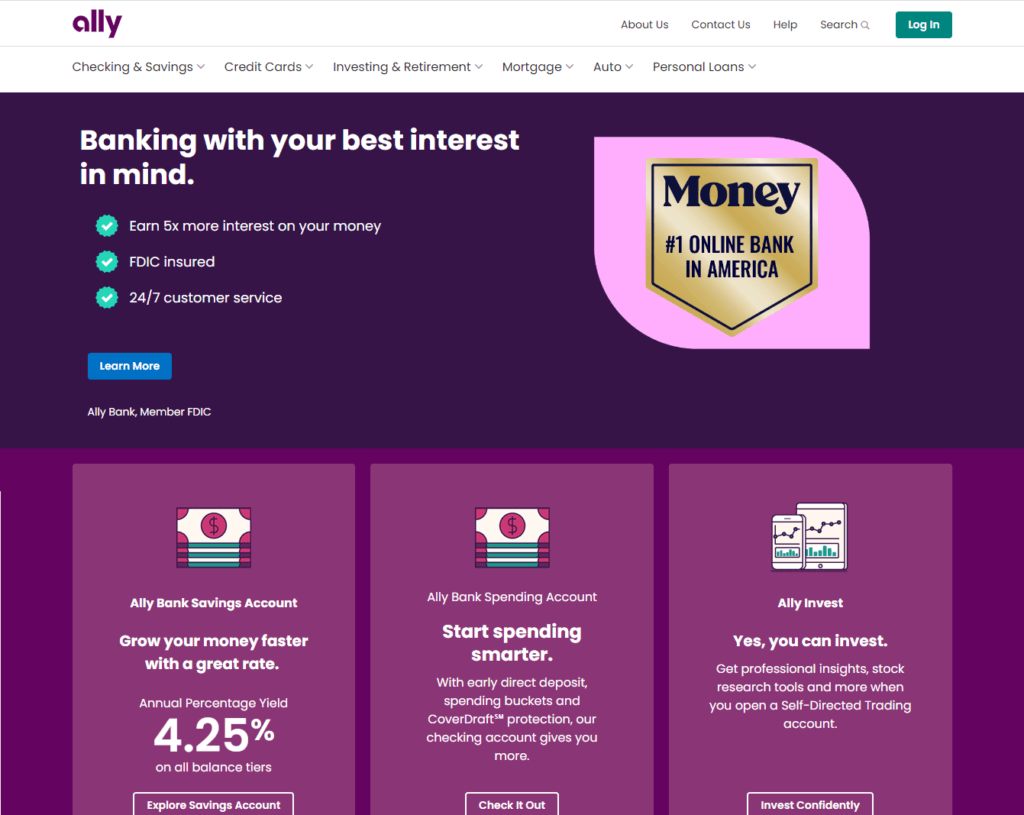

4. Investment in Financial Literacy

Uncommon financial institutions prioritize education alongside their services. They invest in financial literacy programs to empower clients to make informed decisions about their money. Such programs provide workshops, resources, and tools to enhance customers’ understanding of personal finance. For instance, Ally Bank offers a comprehensive online resource center to educate customers about budgeting, saving, and investing.

5. Community-Centric Approach

Some financial institutions place a strong emphasis on community engagement and development. These institutions invest in local projects, support small businesses, and collaborate with nonprofits to uplift their communities. Examples include credit unions that offer personalized services and reinvest profits into their members and neighborhoods.

6. Flexible Payment Plans

Uncommon features, moreover, include innovative payment structures. Furthermore, financial institutions may also offer more flexible payment plans with add-ons for different types of loans and mortgages to accommodate individual circumstances. In addition, this approach also assists many borrowers during challenging times and fosters long-term customer relationships.

Significance of Uncommon Features

These uncommon features in financial institutions highlight the sector’s adaptability to evolving customer needs and societal values. They demonstrate a commitment to responsible business practices, social impact, and innovation. By embracing these features, financial institutions not only stand out in a competitive landscape but also contribute to positive change.

Conclusion

While many financial institutions share common traits, conversely, it’s the uncommon features that truly set some apart. Albeit from ethical investment strategies to digital-only models and community-centric approaches, these features showcase a commitment to innovation, responsibility, and customer empowerment.

In contrast, recognizing the significance of these uncommon features allows individuals to make more informed choices when selecting financial partners. Whether you’re passionate about ethical investments, seeking community-driven banking, or looking for educational resources, these unique aspects can align with your values and financial goals. Moreover, as financial institutions continue to evolve, the integration of these uncommon features emphasizes their dedication to creating a more inclusive and impactful financial landscape.

FAQs

There are many uncommon features such as ethical investment, microfinance, digital-only, financial literacy, community-centric approach and flexible payment plans.

Financial literacy refers to the ability to understand and manage personal finances, including concepts like budgeting, saving, investing, and debt management.

Private banks and investment banks often have higher fees compared to other types of financial institutions.

The income of financial advisors varies based on factors such as experience, location, and the types of clients they serve.

Pell Grants are an example of federal funding that provides free money to students based on their financial need.

To become a financial advisor, one typically needs to complete relevant education, obtain necessary licenses, and gain experience in the field.

Financial aid refers to monetary assistance provided to individuals or students to help cover educational expenses such as tuition, fees, and books.

A financial advisor provides guidance and advice on various financial matters, including investment strategies, retirement planning, and wealth management.

The cost of a financial advisor can vary based on factors such as the advisor’s fee structure, the complexity of services, and the level of customization.

The earnings of a financial advisor can vary widely, influenced by factors such as client base, experience, and geographic location.

A financial advisor is a professional who offers expertise and guidance on managing finances, investments, and financial planning.

Financial literacy refers to having the knowledge and skills to make informed and effective decisions regarding personal finances and money management.